Have you ever wondered if accounting software can effectively track deductible expenses for your business? Managing deductible expenses is a crucial aspect of financial management, ensuring you are maximizing potential tax benefits while maintaining accurate financial records. The ability to track deductible expenses efficiently can impact your financial planning and compliance with tax regulations. In today’s technology-driven world, accounting software offers robust solutions that can simplify this complex process.

Understanding Deductible Expenses

Before exploring how accounting software can aid in tracking deductible expenses, it’s essential to understand what deductible expenses are. Deductible expenses are specific business expenses that can reduce your taxable income, ultimately decreasing the tax liability. These expenses must be ordinary and necessary for the operation of your business.

Types of Deductible Expenses

Various expenses can qualify as tax-deductible, and recognizing these can enhance your financial management strategy. Here are some common types of deductible expenses:

- Office Supplies: Purchases such as paper, pens, and other office essentials.

- Travel Expenses: Costs related to business travel, including transportation, lodging, and meals.

- Employee Salaries and Benefits: Compensation paid to employees, including bonuses and benefits.

- Depreciation: Deduction related to the gradual wear and tear of an asset over time.

- Home Office: Prorated expenses if you use a portion of your home exclusively for business operations.

- Utilities: Expenses for electricity, water, internet, and phone lines used for business purposes.

- Rent and Lease Payments: Costs associated with leasing office space or equipment.

- Insurance Premiums: Business-related insurance costs, such as liability or property insurance.

Understanding these expenses is crucial as they not only impact your financial statements but also influence your taxable income.

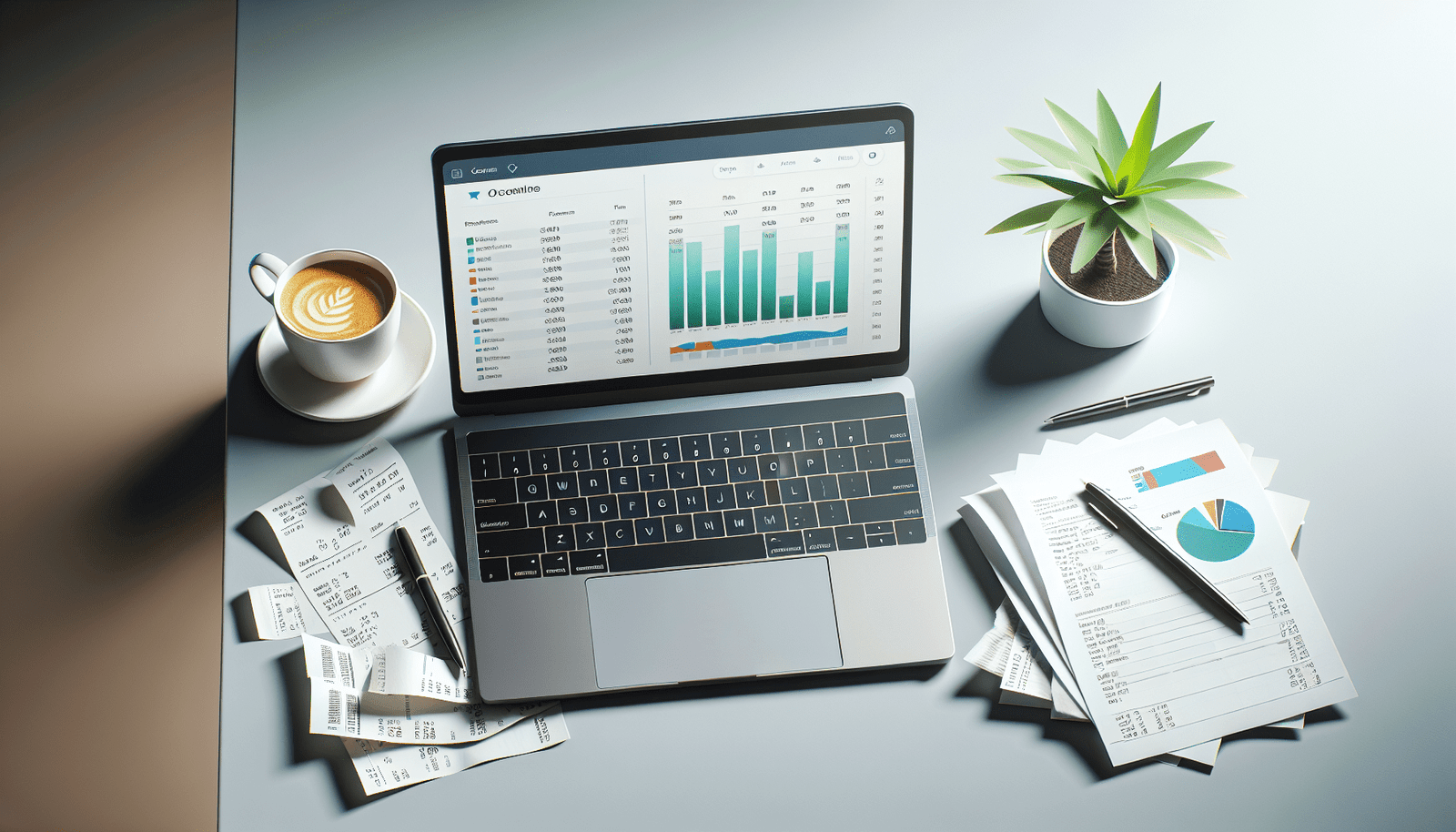

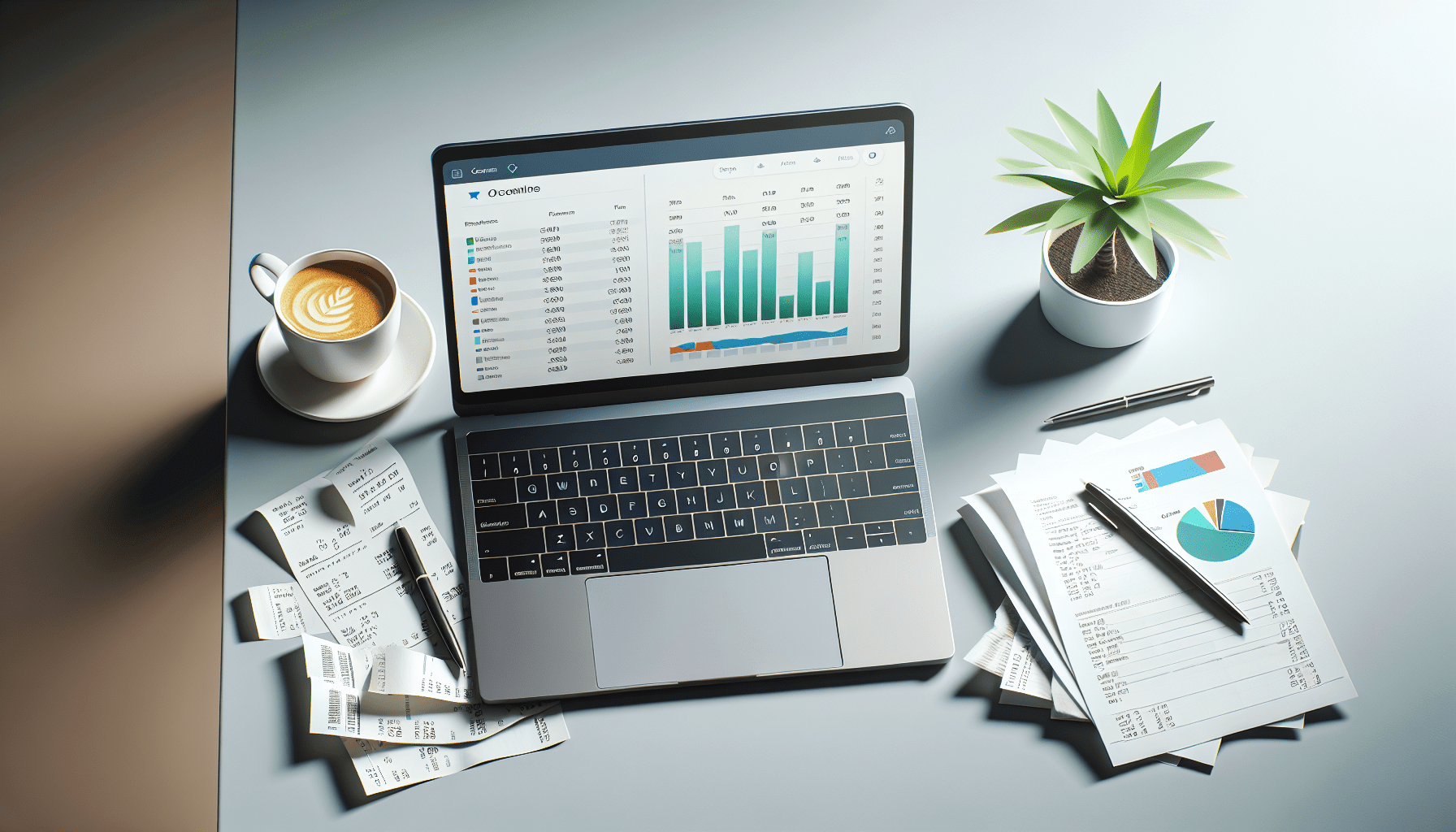

The Role of Accounting Software

Accounting software plays an essential role in helping businesses efficiently manage their financial operations, including tracking deductible expenses. These tools are designed to automate and streamline bookkeeping processes, saving time and reducing human error.

Key Features of Accounting Software

Modern accounting software comes equipped with a variety of features that assist in tracking deductible expenses. Here are some key features:

- Expense Tracking: Automatically record and categorize expenses as they occur, making it easier to identify deductible items.

- Receipts Capture: Upload digital copies of receipts, which are crucial for substantiating deductible expenses.

- Financial Reporting: Generate detailed reports that highlight deductible expenses, ensuring nothing is overlooked during tax preparations.

- Integration with Banking: Sync with bank accounts and credit cards, providing real-time data and reducing manual data entry.

- Customizable Categories: Tailor expense categories to match your specific deductible items, enhancing accuracy.

- Tax Compliance: Stay updated with tax laws, ensuring deductible expenses align with current regulations.

Benefits of Using Accounting Software for Deductible Expenses

Implementing accounting software not only simplifies the tracking of deductible expenses but also offers numerous benefits:

- Accuracy and Detail: Automated systems reduce human error, ensuring financial records are precise and detailed.

- Time Savings: Automating data entry and categorization processes saves valuable time compared to manual bookkeeping.

- Organizational Efficiency: Centralize financial data, making it easily accessible for audits or tax filings.

- Cost-Effectiveness: Reduce the costs related to manual accounting processes and potential errors leading to tax liabilities.

- Real-Time Insights: Gain real-time visibility into financial performance and track deductible expenses continually.

Choosing the Right Accounting Software

Selecting the right accounting software is crucial for effectively tracking deductible expenses. The choice depends on several factors, including the size of your business, industry needs, and budget.

Considerations When Selecting Accounting Software

When choosing accounting software, consider the following aspects to ensure it meets your needs for tracking deductible expenses:

- Scalability: Consider whether the software can grow with your business, adapting to increasing complexities.

- User-Friendly Interface: Ensure ease of use to facilitate quick learning and smooth transition for your finance team.

- Customer Support: Look for software providers offering robust customer support, especially for troubleshooting related to deductible expenses.

- Integration Options: Verify that the software integrates well with existing systems and tools used in your business.

- Security Features: Ensure the software has strong security protocols to protect sensitive financial data.

Top Accounting Software Options

Here’s a table comparing popular accounting software options to aid in tracking deductible expenses:

| Software | Prominent Features | Price Range | Ideal For |

|---|---|---|---|

| QuickBooks | Comprehensive reporting, extensive integrations, cloud-based | $$ | Small to medium businesses |

| Xero | Easy-to-use interface, mobile access, strong security | $$ | Growing businesses |

| FreshBooks | User-friendly, time tracking integration, invoicing | $ | Freelancers and small businesses |

| Zoho Books | Affordable, strong automation features, good integrations | $ | Startups and small enterprises |

| Sage 50cloud | Customizable, robust inventory management, multi-user access | $$$ | Larger businesses |

Choosing the right solution requires evaluating these features against your business’s specific needs for tracking deductible expenses.

Implementing Accounting Software for Deductible Expenses Management

Once you’ve chosen the appropriate accounting software, the next step is to implement it effectively to streamline the tracking of deductible expenses.

Steps to Implement Accounting Software

To ensure successful implementation, follow these steps:

-

Setup Financial Records: Gather all necessary financial data, including previous records and bank statements, for integration into the new system.

-

Define Expense Categories: Customize the categories to match your business’s specific deductible expenses to simplify the tracking process.

-

Train Staff: Provide comprehensive training for your finance team to ensure they are proficient in using the software for tracking purposes.

-

Regularly Review Reports: Schedule routine checks of financial reports to ensure accurate tracking of deductible expenses and make adjustments as needed.

-

Continuous Monitoring: Utilize the software’s automation features to maintain continuous oversight of expenses, staying ahead of any potential discrepancies.

Maintaining Compliance with Regulations

Maintaining compliance with tax and regulatory requirements is essential when managing deductible expenses. Accounting software helps businesses adhere to these standards effectively.

Ensuring Regulatory Compliance

Here are some key points to help ensure compliance with tax laws while using accounting software:

- Stay Informed: Keep abreast of updates in tax regulations relevant to deductible expenses, adjusted by authorities periodically.

- Document Retention: Store and organize all supporting documents digitally within your accounting software to substantiate deductible expenses.

- Periodic Audits: Conduct regular audits using financial reports to ensure all transactions comply with regulatory standards.

- Professional Consultation: Consult with tax professionals to verify that your deductible expense tracking meets legal requirements.

Challenges and Solutions in Tracking Deductible Expenses

Although accounting software is an effective tool for managing deductible expenses, challenges might still arise. Knowing common issues and their solutions can help you navigate these effectively.

Common Challenges

- Complex Tax Laws: Staying updated on deductible expenses affected by changing tax laws can be difficult.

- Categorization Errors: Misclassification of expenses can lead to inaccuracies in tracking deductions.

- Data Security Concerns: Protecting sensitive financial information is paramount, especially with increasing cyber threats.

Solutions to Overcome Challenges

- Regular Training Sessions: Keep staff informed about tax law changes and software updates through continuous education.

- Routine Audits: Establish regular audit cycles to ensure proper categorization of expenses and correct potential errors.

- Enhanced Security Measures: Implement strong cybersecurity protocols and regularly update security software to protect financial data.

Final Thoughts

The integration of accounting software into your business operations can significantly ease the process of tracking deductible expenses, ensuring accuracy, efficiency, and compliance with tax regulations. By understanding the core features and benefits, selecting the right software, and implementing it effectively, you can optimize your financial management systems. The ultimate goal is to streamline expense tracking while minimizing tax liabilities and maximizing potential deductions. Armed with the right tools and strategies, you can confidently manage deductible expenses, contributing to the overall financial health and growth of your business.